Biomanufacturing: Demand for Continuous Bioprocessing Increasing

![]()

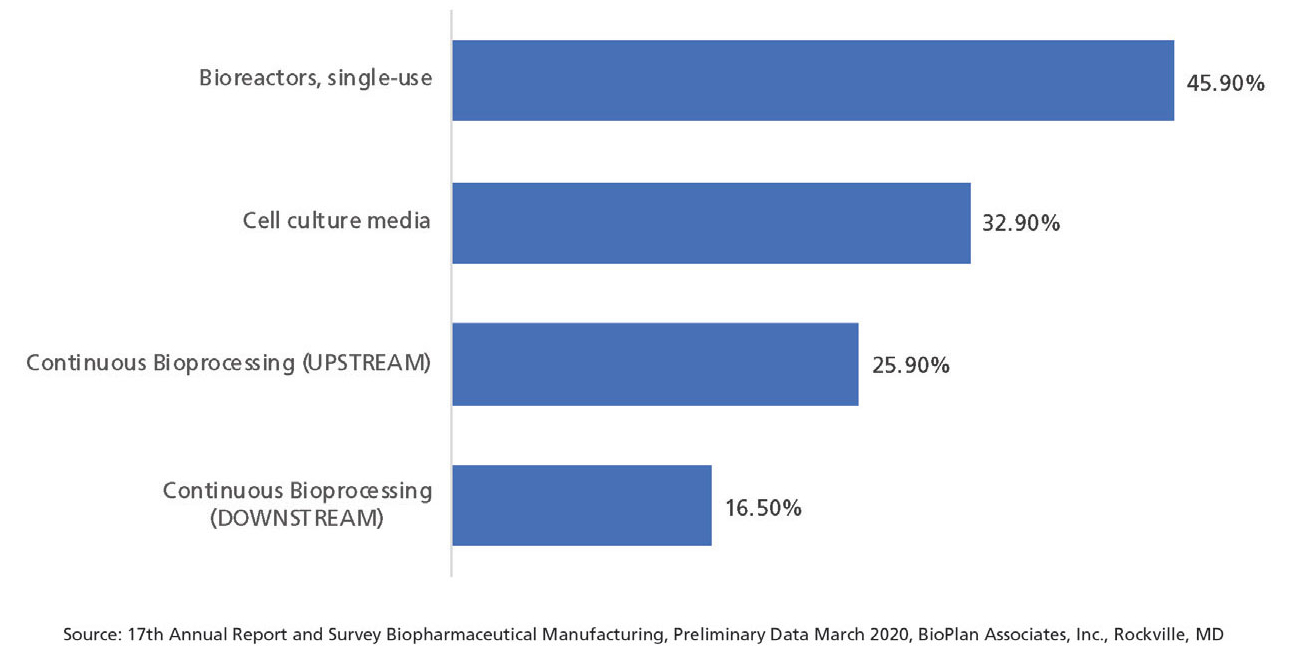

But are innovations sufficient to increase adoption? CMOs are demanding better continuous bioprocessing options.

But are innovations sufficient to increase adoption? CMOs are demanding better continuous bioprocessing options.

In nearly all other manufacturing technologies, cost considerations dictate that continuous production will be the rule. But in bioprocessing, the normal evolution from batch to continuous operations has not moved as quickly as many had expected.

Continuous processing upstream has been around for decades as perfusion (e.g., fiber-based perfusion bioreactors for fused-cell hybridoma culture in the 1980s). But that’s essentially the only continuous-adapted upstream unit process, with such things as culture media and additives preparation still done in batch processing. In some respects, perfusion has overall been a commercial failure. Sales of the leading alternating tangential flow (ATF) perfusion systems from leading suppliers, after more than 15 years, are under $20 million. And continuous processing downstream is still largely lacking and, where implemented, involves just a few of the many unit processes involved in downstream processing. Multi-column, countercurrent, and other variations of continuous chromatography units are just starting to enter the market. The classic and still predominant approach to bioprocessing, both upstream and downstream, remains batch processing, with manufacturing batch fluids essentially moving incrementally en-masse from one process step and set of equipment to the next.

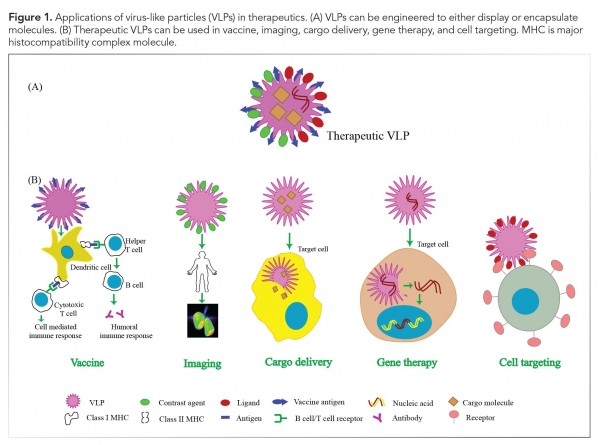

Downstream processing continues to create bottlenecks in production, and improvements in batch processing are not really emerging. Therefore, the industry continues to seek solutions from innovators for better continuous processes that offer further process intensification and lower costs. In fact, 70.6% of bioprocessing professionals are either testing continuous bioprocessing downstream technologies or considering them. This is up from 68% based on data from our 2016 Annual Report (1).

According to BioPlan’s 17th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production (2), there has been a slow increase in assessment of the various continuous bioprocessing options over the past five years, and the data support ongoing interest in the coming year (see Figure 1). Approximately 55% of facilities surveyed are actively or informally evaluating continuous processing technologies in the coming year.

Figure 1: Facilities evaluating continuous bioprocessing (downstream) technologies in the next 12 months 2016 2020. (Figure courtesy of the author)

Figure 1: Facilities evaluating continuous bioprocessing (downstream) technologies in the next 12 months 2016 2020. (Figure courtesy of the author)

Although there are a number of technologies providing process intensification and continuous purification steps, it appears that more robust continuous chromatography technologies, such as simulated moving bed (SMB) and periodic countercurrent chromatography, are generally not yet ready yet for commercial-scale adoption (other than adoptions performed using single-use upstream equipment generally limited to 2000-L scale).

Outsourcing and continuous bioprocessing

Contract manufacturing organizations (CMOs) are often on the leading edge of new technology adoption. For continuous bioprocessing and process intensification, BioPlan’s Annual Report shows that significantly more CMOs will be testing these technologies over the next 12 months (53% of CMOs will be evaluating downstream options, vs 38% of biomanufacturing facilities). On the upstream side, again it is the CMO outsourcing organizations that are seeking better products and more improvements. More CMOs than biomanufacturers (40% vs 28%) are indicating they want vendors to focus greater efforts on developing continuous upstream technologies (1).

Budgets for adoption of continuous bioprocessing

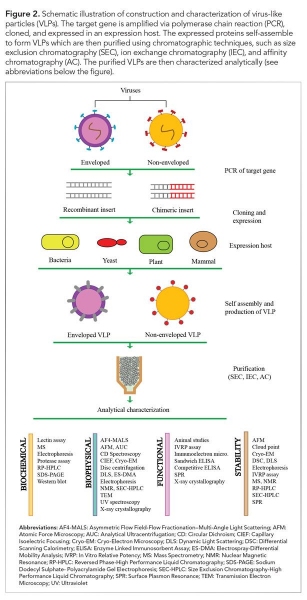

BioPlan’s annual report for 2020 also evaluated adoption of bioprocessing technologies based on new technology purchases. When evaluating new expenditures, industry decision-makers were asked about new technologies they were budgeting for. Of the nearly 20 technologies identified, the top technologies this year included single-use bioreactors (noted by 45.9% of respondents), followed by cell culture media including optimization, and then continuous bioprocessing (upstream), and continuous bioprocessing (downstream), according to preliminary data.

BioPlan data in general indicate that the direction of the industry is more toward single-use novel devices, those that allow rapid transitioning from project to project, and options for continuous bioprocessing. Some of these technologies also support the increasing demand for biologics that may be called for in smaller quantities.

Figure 2 shows the economic commitment decision-makers are focusing on continuous bioprocessing, as evidenced by companies’ top three new expenditures including both upstream and downstream continuous bioprocessing equipment, which was noted by a robust 25.9% and 16.5% response from decision-makers.

Figure 2: New expenditures, 2020 (Figure courtesy of the author)

Figure 2: New expenditures, 2020 (Figure courtesy of the author)

Trends making continuous bioprocessing attractive

Several technological advances and related trends are making continuous bioprocessing attractive. Some established bioprocessing facilities are being retrofitted and upgraded for more continuous operations.

There are many benefits to operating bioprocesses continuously rather than in batch mode, with many of these similar and complementing those of single-use and modular systems:

- Reduced costs: Operating continuously allows use of significantly smaller-scale equipment, with a smaller volume bioreactor.

- Increased productivity: Because much of the bioprocessing equipment is operated continuously, there is little need for large transfer/storage vessels and no halts between processes. Bioprocessing thus tends to move much more smoothly.

- Improved quality: Biological molecules are expressed continuously, and compared to batch culture, continuous culture tends to be more controllable, less intense and stressful, including less shear and media nutrient levels kept constant.

- Increased flexibility: Continuous manufacture enables more adaptability and efficient facility utilization, similar to the advantages of single-use devices. Bioprocessing also becomes much more portable, and facilities more cloneable.

Many upcoming continuous bioprocessing technologies are very novel. For example, a single 50-L bioreactor is expected to be able to manufacture the same quantity of product, often at better quality, comparable to a 5000-L bioreactor over the same time period. Case studies and other reports of such performance will further promote rapid adoption. There will be increasingly rapid adoption of single-use systems for new commercial manufacturing over the next five years; and continuous bioprocessing, particularly upstream processing, is expected to follow a similar trajectory. Use of continuous bioprocessing is likely to further increase with the arrival of more hybrid systems that use bolt-on-type technology, which retrofit components unit operations for existing systems. Other conventional downstream continuous adaptable technologies, such as centrifugation, will also see increasing adoption in coming years. Potentially revolutionary capillary fiber perfusion bioreactors and other new technologies, including those for downstream processing, will be likely coming online and be more widely adopted for commercial manufacture over the next 10 years.

Continuous processing trends in bioprocessing

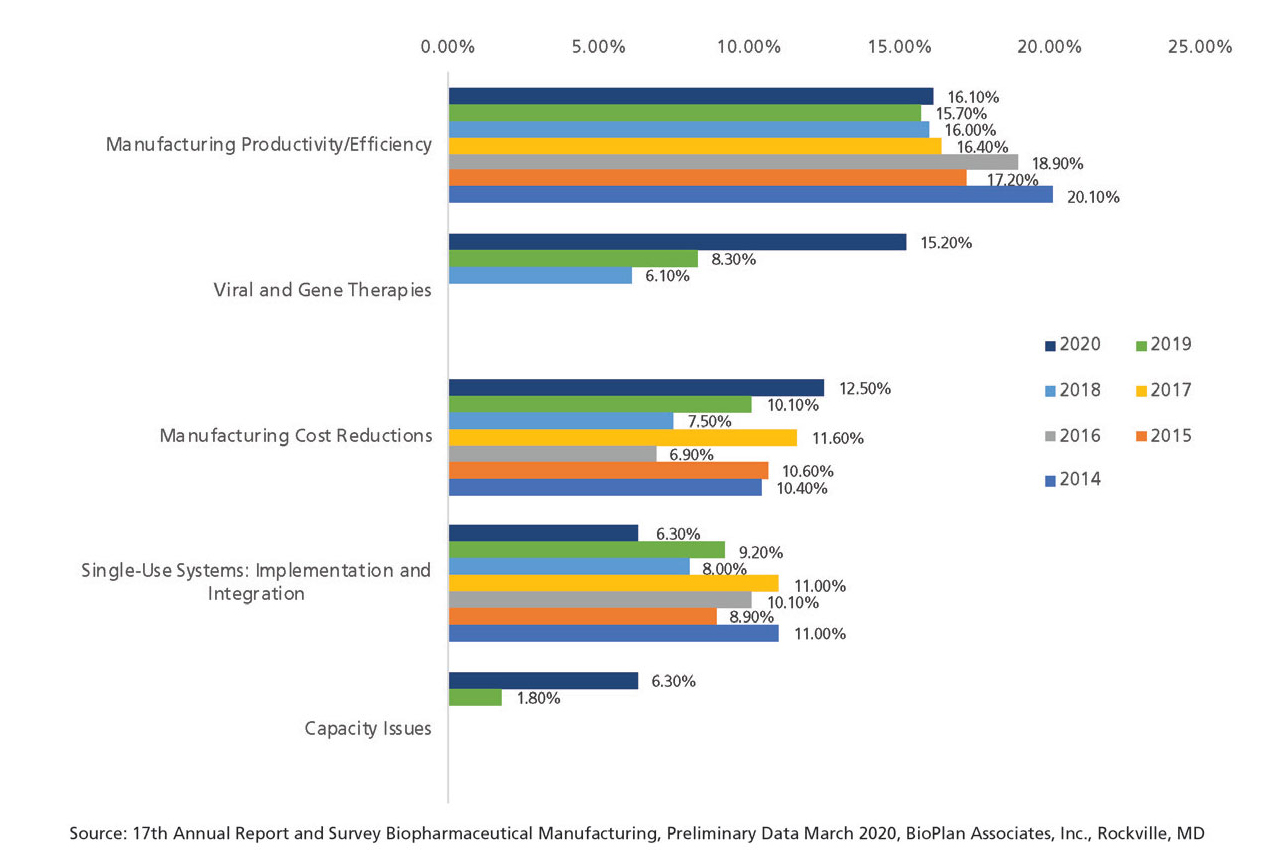

When respondents were asked about their ‘single most’ important biomanufacturing trend, or operational area on which the industry must focus its efforts, upstream and downstream continuous bioprocessing declined dramatically over the past six years, from 9.1% to 1.25% for upstream, and 10% to 4.7% for downstream continuous bioprocessing (Figure 3).

Figure 3: Single most important biomanufacturing trend (2014 2020) (Selected Findings). (Figure courtesy of the author)

Figure 3: Single most important biomanufacturing trend (2014 2020) (Selected Findings). (Figure courtesy of the author)

While this might imply that interest in continuous bioprocessing is waning, combined with the increased expenditures in the area, it suggests that continuous bioprocessing is becoming a more mainstream bioprocessing area, and therefore, less trend-relevant, thus, the lower trend ‘score.’

Implementation of continuous bioprocessing

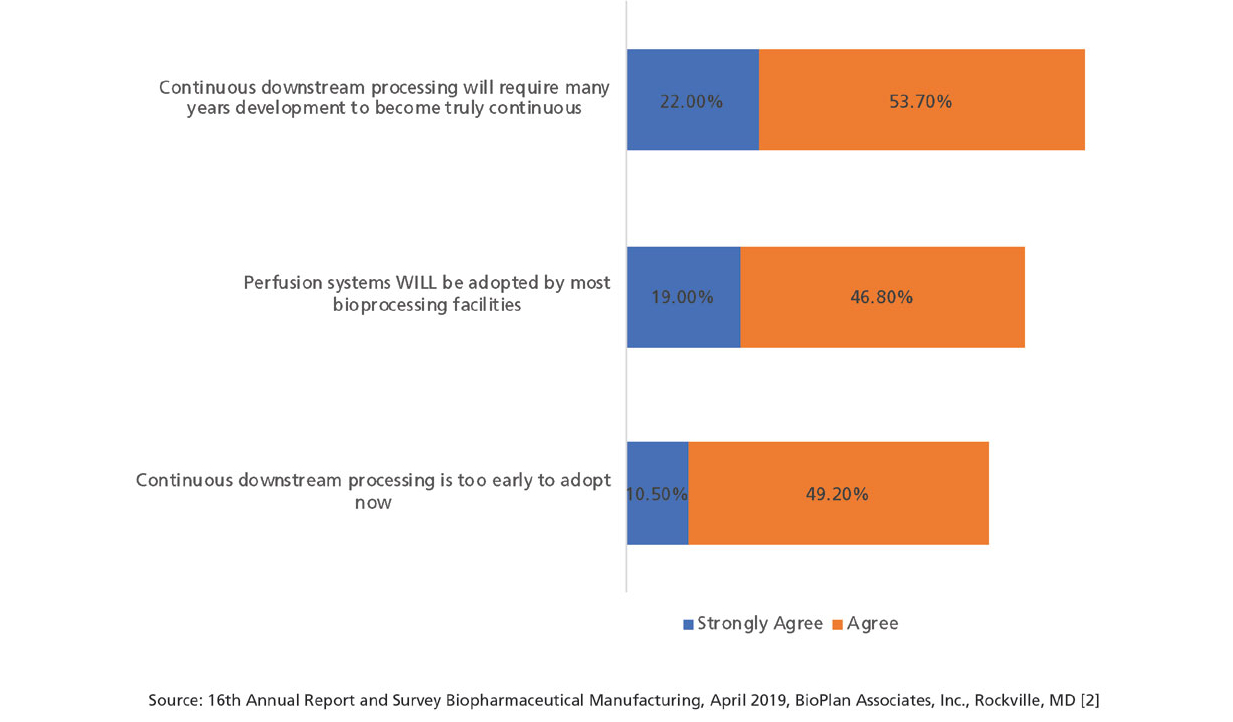

Although this is beginning to change, implementation of continuous bioprocessing is and has been slow (see Figure 4). At best, a few unit process/steps both up- and/or downstream have been implemented as continuous by a minority of facilities. Some commercial biopharmaceutical products that essentially require perfusion’s generally milder/less intense processing conditions, including Factor VIII (the largest recombinant molecule biopharmaceutical) and coagulation factors, have been manufactured for decades using perfusion (other products use continuous centrifugation).

Figure 4: Perspectives on continuous bioprocessing and process intensification (Selected Data) (2). (Figure courtesy of the author)

Figure 4: Perspectives on continuous bioprocessing and process intensification (Selected Data) (2). (Figure courtesy of the author)

BioPlan studies have shown approximately 5% of bioreactors that are over desktop-size use perfusion, mostly for feeder, not production, bioreactors. There is more adoption of perfusion for early stage vs. large/commercial-scale manufacturing. BioPlan studies have shown that few processes are scaled-up, particularly for commercial good manufacturing practice (GMP) manufacture, using perfusion in continuous upstream bioprocessing CP USP. Perfusion adds considerable mechanical complexity and regulatory uncertainties (i.e., it is avoided for GMP manufacturing, expert staff are needed, etc.), as well has having limited equipment options and universal industry inertia restraining adoption.

Large-scale continuous downstream processing, particularly chromatography operations, remain rare. Even where continuous downstream processing has been implemented, it involves at best only one or few out of the usual multiple chromatography and other downstream processing unit processes/steps having been implement as continuous.

Survey data suggests that bioprocessing professionals may believe continuous processing is more ready for broad adoption for more unit processes than it currently is. Notably, continuous processing equipment manufacturers and users report that many of the problems long associated with perfusion and continuous bioprocessing have been resolved in recent years through the application of innovative technologies, including new developments in single-use equipment.

On the other hand, perfusion processing is now significantly less complex, less prone to contamination, and more readily scalable than previously. Negative assessments from within the industry of continuous perfusion fed-batch processing overall may reflect a lack of direct exposure or experience with continuous technology.

In BioPlan’s annual report, for example, key areas where most respondents reported they perceive perfusion as presenting more concerns (vs. fed-batch) included:

- - Process operational complexity (perfusion noted by 72% as more operationally complex vs. batch)

- - Contamination risks

- - Upstream development and characterization time

- - Process development control challenges

- - Process development general challenges

- - Validation challenges

- - Need for greater process control

- - Cell line stability problems

- - Ability to scale-up process.

Interestingly, while approximately 76% believe downstream continuous bioprocessing will be a long time in coming, 66% believes that perfusion systems will be adopted by most bioprocessing facilities. This shows the expectation that continuous bioprocessing is here for the long haul, but widespread adoption may not be in the near future.

References

1. BioPlan Associates, 16th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production (Rockville, MD, April 2019).

2. BioPlan Associates, 17th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production, Preliminary Data (Rockville, MD, March 2020).