Capacity for complex therapeutics is becoming increasingly difficult to predict.

By Randi Hernandez

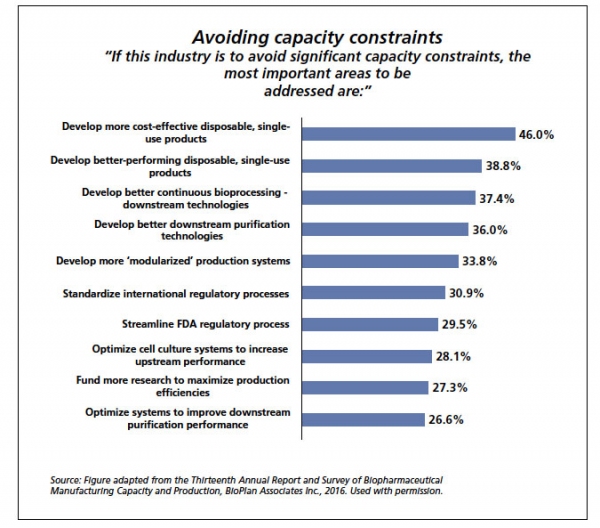

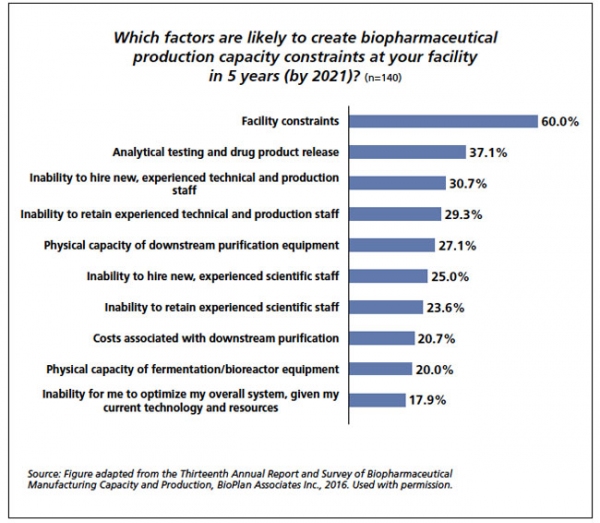

Demand for any given new product is typically only known after significant investments have already been made. Because executives commonly plan capacity requirements based on launch forecasts, there are many factors that can lead to miscalculations of capacity, making it challenging to know what capacity to build into a facility. According to a new survey by BioPlan Associates, more than half of respondents (60%) expect facility constraints to create biopharmaceutical production capacity constraints by 2021 (1). BioPlan found that the development of more efficient single-use products, better downstream purification technologies, the introduction of continuous downstream operations, and increased modularization of production systems were identified as the top things the industry must do to avoid further capacity restrictions at biomanufacturing plants (Figure 1). Analytical testing concerns and adequate hiring of qualified personnel to manage the facilities are among the other top issues that are expected to create capacity limitations in the future (Figure 2).

Demand for any given new product is typically only known after significant investments have already been made. Because executives commonly plan capacity requirements based on launch forecasts, there are many factors that can lead to miscalculations of capacity, making it challenging to know what capacity to build into a facility. According to a new survey by BioPlan Associates, more than half of respondents (60%) expect facility constraints to create biopharmaceutical production capacity constraints by 2021 (1). BioPlan found that the development of more efficient single-use products, better downstream purification technologies, the introduction of continuous downstream operations, and increased modularization of production systems were identified as the top things the industry must do to avoid further capacity restrictions at biomanufacturing plants (Figure 1). Analytical testing concerns and adequate hiring of qualified personnel to manage the facilities are among the other top issues that are expected to create capacity limitations in the future (Figure 2).

Flexible solutions

Even if demand is accurately predicted, changes to a development plan can also occur that require facility changes, says Christian Wyss, attorney at Vischer AG, who specializes in drafting and negotiating contracts for clients in the life sciences. These developments can arise because an opportunity presents itself to improve a drug or add more indications—or, scientific issues may have to be addressed that were not planned. Wyss notes that there could also be problems with a technology transfer. “Either the manufacturing process was not as robust as the sponsor thought it was, or the tech transfer failed to successfully convey all subtleties to the contract manufacturing organization [CMO].”

Figure 1: The top 10 areas to address to avoid capacity constraints, according to a survey of biomanufacturers.

To alter technical capacity, a facility has to have “solution-oriented professionals that are willing and able to find room for flexibility in a highly regulated environment,” says Wyss. The change can become more complicated if there is a change in product type, which may even require a completely different facility, says Tom Ransohoff, vice-president and principal consultant at BioProcess Technology Consultants. It is more difficult to respond to shifting demands if process equipment and clean utility systems are hard piped into the infrastructure, says Parrish Galliher, CTO for upstream at Cytiva. Multiple closed-off cleanroom sections in facilities, numerous heating/ventilation/air conditioning zones, and low ceilings (which limit types and scales of new equipment) can also serve as barriers to rapid capacity expansion, Galliher states.

Figure 2: The top 10 factors creating future capacity constraints, as identified by a survey of biomanufacturers in 2016.

Figure 2: The top 10 factors creating future capacity constraints, as identified by a survey of biomanufacturers in 2016.

Forecasting long-term demand during the transition from clinical to commercial is challenging, says Ransohoff. He adds that to meet uncertain or changing demands, one strategy is to “number up,” or use multiple single-use bioreactors to achieve a range of upstream scales. Galliher concurs that adding extra operating shifts to an existing facility helps rapidly expand capacity, as well as overlapping or “staggering” of batches to meet need. According to a report compiled by Patheon, ORC International, and PharmSource, demand and capacity forecast inaccuracies have prompted biopharmaceutical companies to embrace the use of outsourcing with more fervor than ever before (2).

Forecasting capacity needs

A multitude of unforeseen circumstances can skew capacity forecasts. Some of these could include reports of a serious adverse event, slow enrollment in clinical trials, sale of a parent company that is developing the drug, an unusually successful marketing strategy, provider motives and incentives, final cost to the patient, willingness for a payer or pharmacy benefit manager to reimburse a drug, a change in raw material availability, availability of new therapeutic alternatives, or new regulatory legislation.

In a Nature Reviews Drug Discovery study from 2013, investigators concluded that more than 60% of companies miss their demand forecasts by at least 40% (3). A significant number of companies were also overly optimistic by more than 160% of the actual peak revenues that a product could pull in. Even up to six years post-launch, forecasts were still found to be off the mark by percentages as high as 45%. The researchers found that demand for oncology drugs was most commonly underestimated, most likely because of the additional indications for which these drugs earned approval by FDA after initial launch. This demand underestimation is an important finding considering the large number of biologic, immune-oncology therapeutics (with various proposed indications) that are currently in the pipeline. The authors found that analyst forecasts for generic therapies were also markedly off-target (3). These findings could have implications for future demand calculations for biologics, as well as biosimilars with numerous market competitors—especially if the Centers for Medicare and Medicaid Service’s proposal to use reference pricing for all groups of therapeutically equivalent drugs under Medicare Part B (even for biosimilars that are not interchangeable) comes into effect.

A 2007 article in Pharmaceutical Executive estimated that a launch delay costs an average of $15 million per drug per day (4). This number changes, however, depending on the market demand of the drug in question. “The general rule is that a biologic will generate, on average, $300 million per year. So, each day delayed is a loss of $1 million,” estimates Galliher. “I have seen much larger numbers in print for blockbusters,” he adds.

Including post-approval R&D costs, as well as costs associated with unsuccessful projects, the estimate for the average out-of-pocket cost to develop a new compound was found to be $2870 million (in 2013 dollars), according to an analysis by DiMasi et al. that appeared in the May 2016 issue of the Journal of Health Economics (5). Even though there have been slight methodological differences in DiMasi et al.’s studies since 2003—when the authors began looking at the cost of bringing a drug to market—this cost of development has still increased substantially since 2003. Additionally, said the authors of the study, “clinical success rates are substantially lower for the studies focused on more recent periods” (5). Thus, because failure rates have increased and the cost of developing a drug has also increased so markedly, it is increasingly difficult to accurately predict the demand for a drug—as well as that drug’s associated capacity requirements.

Indeed, many industry experts agree that predicting capacity will become even more problematic for pharmaceutical manufacturers in the future because of market access issues. In Europe, because physicians seem to be more accepting of biosimilars, market penetration forecasts may be a bit more clear—but in the United States, physician acceptance and prescribing practices (as well as the interchangeability status of a biosimilar) may make launch and capacity predictions increasingly challenging.

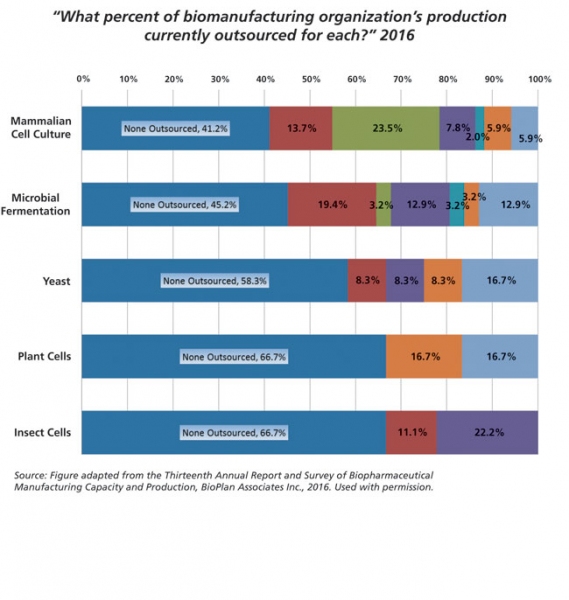

Hybrid capacity vs. other modelsWhile it seems like a number of pharmaceutical companies still rely on a largely in-house approach to managing capacity, most large firms have been open to the concept of using outside CMOs to meet short-term requirements. Small firms often use a completely outsourced model to meet capacity. The percentage of production that is outsourced at each biomanufacturing firm depends largely on what type of product is being manufactured. According to numbers from the 2016 BioPlan report (1), approximately 59% of respondents used at least some outsourced capacity for mammalian cell culture, 55% used outsourcing for microbial fermentation, 42% used outsourcing for production in yeast, 33% outsourced for production in plant cells, and 33% outsourced capacity for production of therapies in insect cells (see Figure 3).

Figure 3: Current percent production outsourced; by system.

Figure 3: Current percent production outsourced; by system.

Companies such as Amgen, Bristol-Myers Squibb, and Roche use hybrid approaches for the production of their medications. Wyss estimates that almost all biotech companies that have several products on the market use a mixed approach to manufacturing, but most companies keep the number of CMOs that they work with to a minimum. An exception would be a small biopharma company with few products, says Wyss. “Drug development companies with no product on the market or one-product companies often rely on CMOs only and do not use in-house manufacturing. When the date for market launch is set, these companies will often look for additional CMOs to back up their supply chain.”

Excess capacity

As mentioned, it is common to overestimate or underestimate demand for a drug. Overestimating can lead to the manufacture of too much product, which would then have to be disposed at the manufacturer’s cost. Or, if an overestimation becomes apparent prior to production, gaps in revenue could appear, and the company must somehow fill capacity.

Idle capacity at CMOs can sometimes be handled without disruption (provided that notice is given to the CMO in advance), and the CMO can use the capacity for other customers, says Wyss. If little to no notice is given, Wyss says that costs for equipment remaining idle “can be 80-90% of the costs of manufacturing, at least for a couple of weeks or months.” While costs to maintain an idle facility may be high, says Ransohoff, “they are much lower than the economic losses associated with failing to supply the market demand for a highly profitable biopharmaceutical.”

Facilities can become idle for various reasons, including the failure of a late-stage product to get approval by FDA or the failure of a new product to gain market share. Ransohoff points out that some large companies also purposely keep some capacity available to account for “unanticipated surges in demand.”

Ransohoff notes that he has seen some companies using their excess capacity for the production of biosimilars, citing Biogen’s manufacture of Biogen/Samsung Bioepis’ etanercept biosimilar Benepali as an example of this trend. Sometimes CMOs use provisions that are built into contract agreements to resell unused capacity, which Ransohoff says helps CMOs mitigate the “costs of typical ‘take or pay’ provisions for clients,” or the costs to reserve facility time regardless of if capacity was used.

Wyss argues, however, that he does not expect excess capacity in-house to be used for the production of biosimilars too often: “To my knowledge, even pharma companies having both original products and biosimilars strictly separate the supply chain management for original products and biosimilars.”

Capacity reductions: Decreasing volumes without compromising quality or revenue

In general, a decrease in capacity is viewed as a negative event, and companies are more reticent to announce capacity reductions. “Decreases in capacity/moth-balling facilities are generally not positive developments for companies since they represent inefficient utilization of capital, often resulting from a failure of a product candidate (or candidates) in clinical trials or of a manufacturing business model to develop as planned,” states Ransohoff. “By contrast, increases in capacity signify optimism for the future of the company’s products or manufacturing business model.”

Indeed, as facilities age, they may have to be updated or taken offline entirely. “Retirement of very old plants is being exceeded by new capacity growth, [and] overall capacity needs are growing,” notes Greg Guyer, leader in biologics development and operations at Bristol-Myers Squibb (BMS). Announcements of capacity reduction are indirectly seen when sites are sold between companies, he says. In fact, the sale of these types of facilities can have a positive spin, notes Galliher. When the sale of an older facility occurs, “fiscal responsibility is also being demonstrated by closing unnecessary capacity and selling off underutilized assets, in which case positive financial/investor outcomes can result.”

There is new evidence that a capacity decrease may not necessarily have negative connotations. For example, concentrated fed-batch (CFB) cell culture has been shown in early experiments to yield products of similar quality compared with those made through traditional fed-batch culture (6). Not only could these concentrated fed-batch runs be manufactured at lower volumetric capacities (meaning smaller facilities could accommodate volumes typically seen at larger facilities), the resulting products were also shown to enhance cell-line charge heterogeneity, proving that concentrated fed-batch could be associated with “both process and product quality benefits” (6).

Despite these benefits, concentrated fed-batch used more perfusion and feed media, required numerous filters, and also overloaded downstream processes, causing filter fouling in some cases. The yields obtained in the Yang study (6) were not sufficient enough to suggest totally replacing larger facilities, but the technique has potential for some slow-growing cell lines. While it may not be economically feasible for a legacy system to be converted to CFB, Yang et al. wrote that new companies seeking flexibility in capacity operations might want to consider trying CFB to meet their production needs. The authors concluded, “The key to unlocking the cost and capacity savings of concentrated fed-batch is increasing the specific productivity of the process through cell line and process development.”

Working with CMOs

The use of CMOs can be helpful when there are fluctuating capacity and demand conditions, but sometimes a biopharma company may be wary of the CMO model. A biopharma company may initially choose an “in-house” approach because it fears the leverage a CMO can gain over its business. “The leverage stems from the fact that the CMO/contract development and manufacturing organization [CDMO] has all manufacturing knowledge, and there is always a substantial risk that technology transfer will not be successful immediately,” states Wyss. Thus, he says, detailed technology transfer plans are crucial.

If a CMO/CDMO has its own proprietary manufacturing platform, a biopharma company cannot easily transfer the process back in-house or to another CMO, Wyss points out. “If the contract manufacturing agreement does not give the sponsor a license to this technology solely for the continued production of this specific biologic drug, the manufacturing process will have to be partially re-designed, which is practically not feasible from a time and cost perspective.”

Intellectual property barriers to capacity outsourcing

Manufacturers typically choose an in-house model to keep better control of their supply chain, handle development risks, manage speed of development and launch, and for tax purposes, says Ransohoff—but another important reason to keep production in house is to ensure protection of a company’s intellectual property (IP).

There seems to be mixed responses about whether or not the protection of IP is a significant problem when working with CMOs. Guyer says when BMS outsources, it establishes clear contract provisions to protect its IP, and if it cannot reach agreeable IP terms with CMO partners, it simply does not work with that CMO. He says BMS rarely finds IP to be a barrier to successful relationships with outsourcing partners. Conversely, Cytiva’s Galliher sees IP as a “major issue” for CMOs when joint ownership of technology platforms and/or inventions exist. “The customer usually wants to retain its rights to the drug and cell line and how it is made, especially if proprietary techniques are used. The CMO wants the business freedom to use the process techniques for other customers and its own cell line if it is providing it.”

Although there many be significant advantages in terms of labor costs when using foreign outsourcing operations, specifically, concerns about keeping IP secure often prevail, says Wyss, and as a result, pharma companies rarely outsource to countries with perceived weak patent protection or in areas where national laws provide for mandatory licenses to local generic drug manufacturers. “It seems that originator companies have been able to solve all quality related issues when manufacturing in those countries, but are still reluctant to expose themselves to these legal risks before patent expiry.” Wyss tells this publication that intellectual property issues come into play most when a manufacturer is deciding between different CMOs in various parts of the country. He adds, “many countries have regulations requiring that at least a part of the manufacturing of the drugs sold is accomplished within that country, either directly by relevant legislation (such as in Russia), or indirectly by making this a requirement to obtain research funding or collaborate with public academic institutions (e.g., the standard Cooperative Research and Development Agreement in the United States requires manufacturing in the US).” On the other hand, Galliher mentions that it is also relatively common for some companies to choose a foreign CMO to handle capacity specifically to avoid local IP legislation.

ALL FIGURES ARE COURTESY OF BIOPLAN ASSOCIATES.

References

1. BioPlan Associates, Inc., Thirteenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, April 2016.

2. ORC International, Patheon, and PharmSource, “Impact of Incorrect Forecasts on New Product Launches,” Industry Report, 2016.

3. M. Cha, B. Rifai, and P. Sarraf, Nat. Rev. Drug Disc. 12, pp. 737–738 (2013).

4. T. Noffke, "Successful Product Manager's Handbook", a supplement to Pharmaceutical Technology (March 2007), accessed April 30, 2016.

5. J.A. DiMasi, H.G. Grabowski, and R.W. Hansen, J. Health Econ. 47, pp. 20–33 (2016).

6. W.C. Yang et al., J. Biotechnol. 217, pp. 1–11 (2016).